Week of September 14th

Higher

Pants’ Macro Model (PMM): Pointing toward Expansion.

I am still being cautious and watching for signals that we are peaking or in a melt-up → top → contraction scenario.

PMM Long Suggestions: Equities, Copper, Cyclicals, Emerging Markets, Crypto

PMM Short Suggestions: USD, Bonds (I am long TLT), Vol

Directional Bias, Equities:

ES: Long | Base: 6592 | R1: 6653, R2: 6691, R3: 6752, R4: 6814, R5: 6852 | S1: 6531, S2: 6493, S3: 6432, S4: 6370 S5: 6332

NQ: Long | Base: 24017 | R1: 24314, R2: 24498, R3: 24795, R4: 25092, R5: 25276 | S1: 23720, S2: 23536, S3: 23239, S4: 22942 S5: 22758

RTY: Long

EFA: Neutral

Directional Bias, Rates & Bonds:

TLT: Long

US10Y: Long

US10Y/US02Y: Long/Widening

Directional Bias, Commodities/Inflation:

GC: Neutral

CL: Neutral

HG: Long

Directional Bias, Currency & Liquidity:

DXY: Neutral/Short

BTC: Long

ETH: Long

Directional Bias, Credit:

HYG/TLT: Long

HY OAS (High Yield Credit): Neutral/Short

My Current Positioning (Futures, Shares, Crypto, Options):

Longs:

Gold | /1OZZ25 + 10 @ 3,613.43

Bitcoin | /MBTU25 + 1 @ 110,190

IONQ 32.38 avg, 14.81% allocation

RKLB 23.29 avg, 12.93% allocation

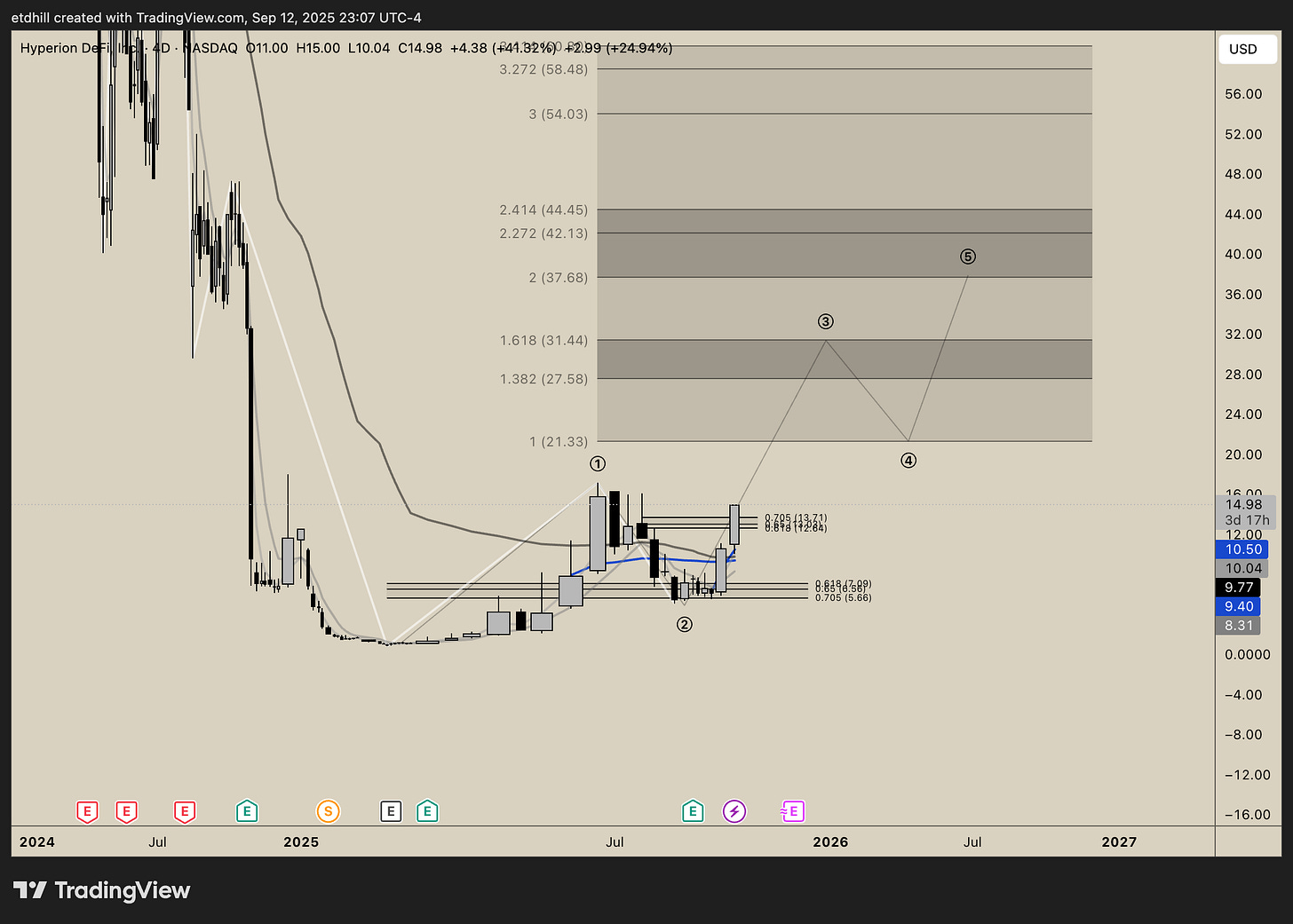

HYPD 10.64 avg, 11.50% allocation

LMND 33.65 avg, 9.01% allocation

HOOD 42.66 avg, 7.05% allocation

OKLO 68.40 avg, 6.05% allocation

NBIS 54.72 avg, 5.51% allocation

RR 2.00 avg, 4.84% allocation

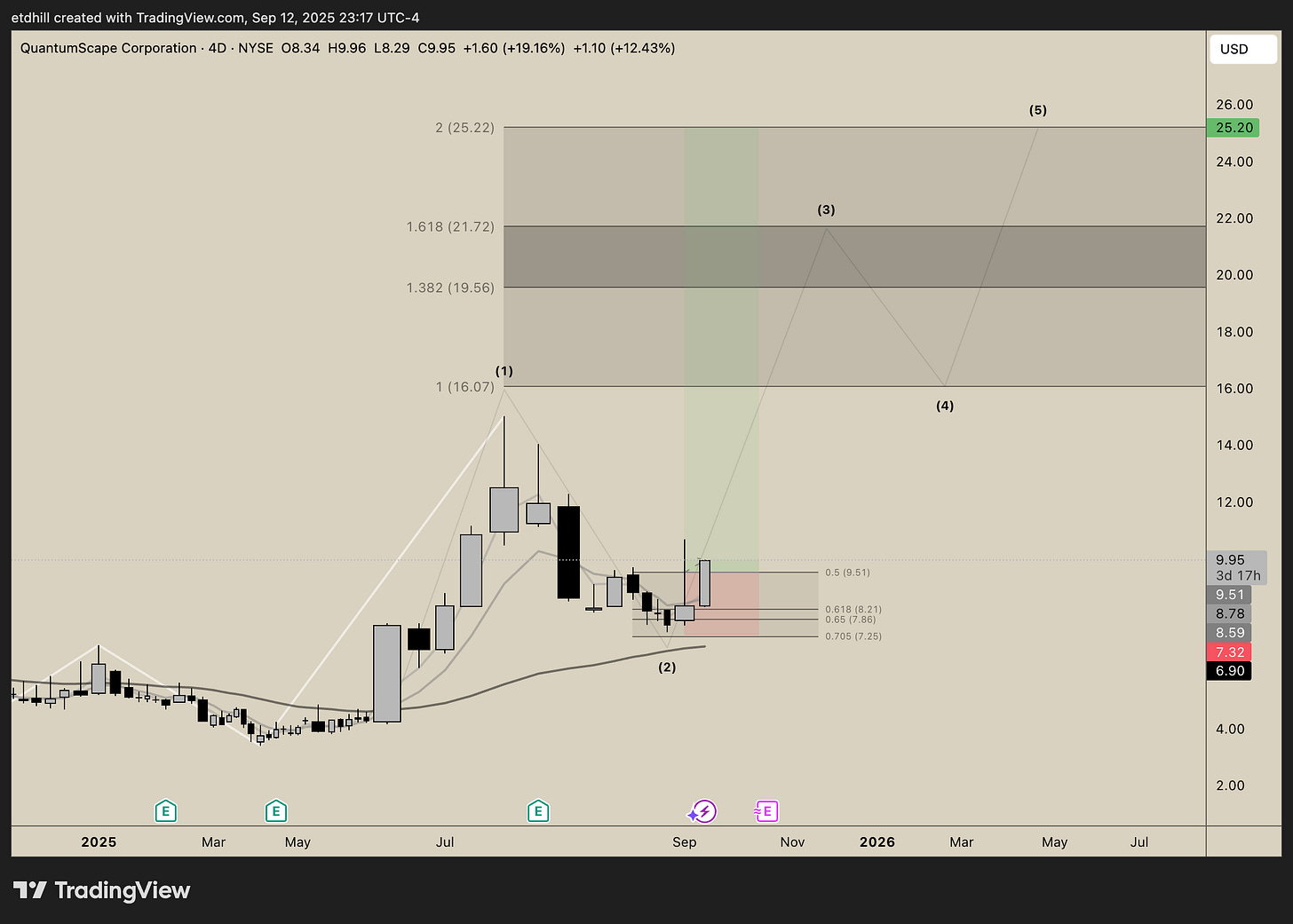

QS 9.25 avg, 4.84% allocation

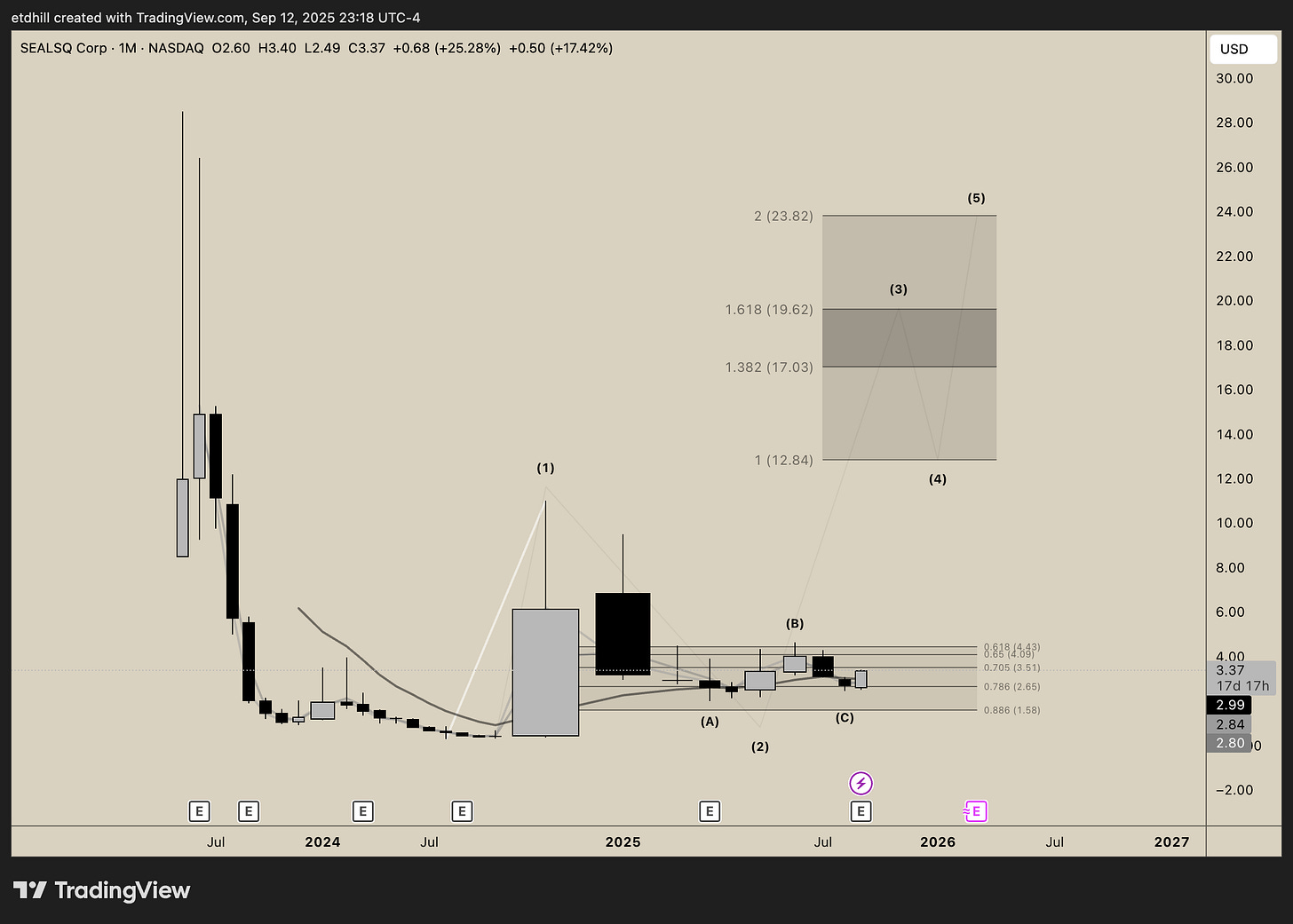

LAES 2.66 avg, 4.77% allocation

TLT 87.56 avg, 4.40% allocation

ATAI 3.40 avg, 3.42% allocation

UUUU 10.89 avg, 2.93% allocation

Options:

BULL $12.5 Call 1/16/26

ABCL $5 Call 1/16/26

OSCR $14 Call 1/16/26

PRME $5 Call 1/16/26

MNMD $10 Call 1/15/27

GRAB $7 Call 12/17/27

Charts / Technical Analysis:

Gold/GC:

Bitcoin:

IONQ:

RKLB:

HYPD:

LMND:

HOOD:

OKLO:

NBIS:

RR:

QS:

LAES (10x Opportunity):

TLT:

ATAI:

UUUU:

Additional Charts/Requests:

CACC:

Range-bound for years now, I would be a seller in the top quarter, and a buyer in the bottom quarter, sideline in-between.

~

The content published on this Substack is for informational and educational purposes only. I am not a licensed financial advisor, and nothing here should be construed as financial, investment, tax, or legal advice. Any opinions, analyses, or strategies discussed are personal views and do not constitute recommendations to buy, sell, or hold any securities or financial instruments.

Trading and investing carry significant risks, including the possible loss of principal. You are solely responsible for your own financial decisions. Always do your own research and consult with a qualified financial professional before making any investment decisions.

By reading this Substack, you acknowledge and agree that I am not liable for any actions you take or outcomes that result from the use of this information.