The Complete Guide to Elliott Wave Theory (And How I Use It)

This post is both a full guide to Elliott Wave Theory (everything you need to know to use it), and a look at how I personally apply it (where I bend, what I prefer, how I trade waves).

What is Elliott Wave Theory?

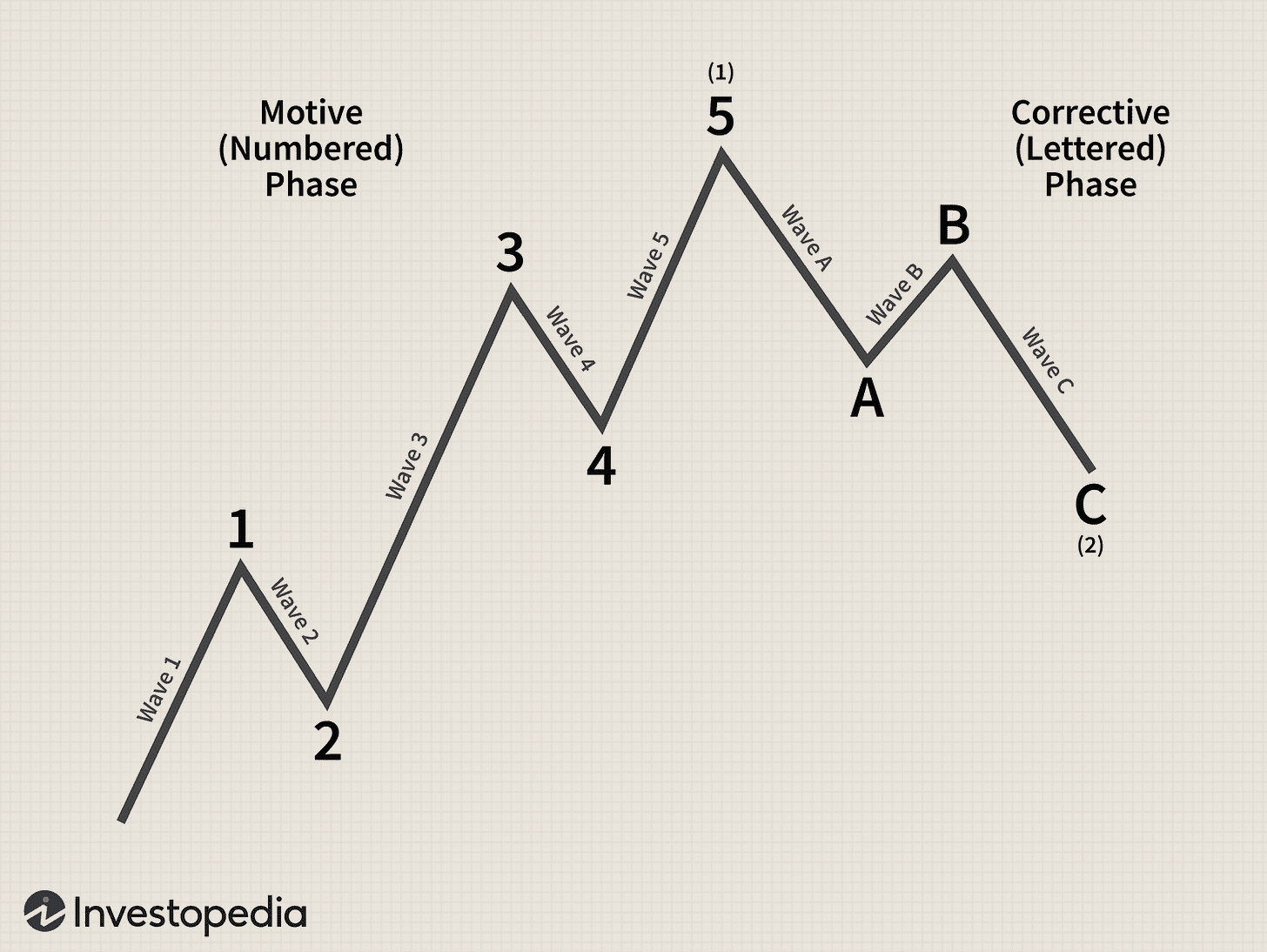

At its core, Elliott Wave Theory (EWT) is a framework for understanding and trading trends. It says markets move in repeating cycles of five waves in the direction of the trend (impulse) and three waves against the trend (correction).

It’s built on two ideas:

Markets are driven by crowd psychology. Every move reflects how investors feel.

These feelings repeat in cycles. Fear, optimism, euphoria, denial. They show up on the chart in waves.

That’s kinda why I like it, it’s part technical tool, and part emotional map of sorts.

The Basic Structure

Markets move in two phases:

Impulse Waves (1–5)

Five waves in the direction of the main trend:

Wave 1: The start. Disbelief. “Suckers Rally”

Wave 2: Pullback. Traders think the rally’s fake, going to 0.

Wave 3: The biggest, strongest move. Everyone piles in, crazy hype on X, your dentist is talking about it, etc.

Wave 4: A short pause/pullback.

Wave 5: Final rally, often euphoric.

Corrective Waves (A–B–C)

Three waves against the trend:

A: First selloff.

B: Dead-cat bounce, people think it’s fine.

C: The actual correction, usually sharp.

Together, that’s one complete cycle: 1–5 up, A–B–C down.

The Core Rules

EWT has a lot of guidelines, but three rules you cannot break:

Wave 3 cannot be the shortest impulse wave.

Wave 2 never retraces past the start of Wave 1.

Wave 4 does not overlap Wave 1.

If your count breaks these, you’re wrong. No exceptions.

Fibonacci and Elliott Wave

Fibonacci ratios are a key tool in EWT. They help project both retracements (pullbacks) and extensions (future targets).

Retracements

Typical levels where waves pull back:

0.382, 0.5, 0.618, and for deeper pullbacks, I like 0.65, 0.705, 0.786, and 0.886 as well.

Extensions

Common wave targets:

1.0 (equal length)

1.618 (classic extended Wave 3 target)

2.618 or 4.236 (less common, but happen in extreme trends).

Types of Corrections

Corrective waves aren’t always clean. They come in a few forms:

Zigzag (A–B–C, sharp drop).

Flat (sideways, messy correction).

Triangle (contracting, indecision).

Complex corrections (combinations of the above).

I sorta get lost trying to label every little move. Personally, I don’t care about how the correction is, I just focus on charting a clean count, 1-5.

How I Personally Use Elliott Wave

Timeframes: I use 4H, Daily, 2D, Weekly, and Monthly. Larger time frames allow me to have cleaner counts.

Weinstein EMA: I use the 150D/30W EMA for stage analysis. When an asset enters Stage 2 (breaking out of accumulation, moving above the 150D/30W EMA with some momentum), that’s when I count waves.

Fibs: The retracements I primarily use are 0.618, 0.65, 0.705, 0.786, and 0.886. The main extensions I use are 1.0, 1.618, and 2.0.

Noise: I don’t care about micro counts. I focus on the big 1–5 moves.

Risk: I don’t sell at Fib targets. I roll stops because I want to catch as much of the move as possible.

Example: IONQ

In March, IONQ pulled back into a clear Wave 2. Everyone hated it, people doubted the company. To me, that’s classic psychology for a Wave 2, disbelief.

I bought the whole way up. Since then, it’s pushed past the 1:1 extension of Wave 1 and hit $73 (at the time of writing) from a $17.91 low in the Wave 2. I’m still holding. No targets—just rolling my stop higher.

That’s Elliott Wave working in real time.

Common Mistakes Traders Make

Forcing counts. If it doesn’t fit the rules, it’s not a wave.

Making Wave 3 the shortest.

Letting Wave 4 cross Wave 1.

Obsessing over corrections. Don’t waste time labeling every squiggle.

Elliott Wave: Art or Science?

Here’s my take:

The rules are strict. If they’re broken, the count is invalid.

But the application is art. Reading markets is intuitive. Some traders learn how to exploit unconventional scenarios, bending rules in ways most people miss.

That’s why I see Elliott Wave as both a structured way of technical analysis, while also being a bit intuitive at the same time. It gives you a framework to follow, but you use your own intuition and experience to fill in the gaps.

How to Start Using It

Here’s a step-by-step approach you can actually follow:

Find assets in Stage 2 (above the 150D/30W EMA).

Identify the first impulse waves.

Look for Wave 2 or Wave 4 pullbacks.

Use Fibonacci retracements to buy the dip.

Use Fib extensions (1.0, 1.618) to project targets.

Ride the trend—roll stops, don’t force a count.

Profit.

Simple.

Lastly

Elliott Wave Theory is just another form of the many types of technical analysis. It won’t make you right every time. But in my opinion, it’s one of the clearest ways to view markets and investor emotions. At least from a high time-frame point-of-view.

You have the generic rules which give you structure. And I’ll give you some details about my style. It’s a bit flexible, I use Anchored VWAP and other MA’s as well as some other tools for volume analysis. Between the two (rules and my style), you’ll have enough to start testing it for yourself.

Use the rules as a foundation, but make it your own, add some other indicators or use fundamentals to guide you, whatever.

Thanks for reading!

~

The content published on this Substack is for informational and educational purposes only. I am not a licensed financial advisor, and nothing here should be construed as financial, investment, tax, or legal advice. Any opinions, analyses, or strategies discussed are personal views and do not constitute recommendations to buy, sell, or hold any securities or financial instruments.

Trading and investing carry significant risks, including the possible loss of principal. You are solely responsible for your own financial decisions. Always do your own research and consult with a qualified financial professional before making any investment decisions.

By reading this Substack, you acknowledge and agree that I am not liable for any actions you take or outcomes that result from the use of this information.