The Art of Pressing: Newton's Law and Why You Suck at Trading

Totis Porcis

Current YTD Return: ~500%

—

Soros continued, “It takes courage to be a pig.”

I tweeted about this and I felt like expanding on it because perhaps this is the value I provide, I see many people talk about how psychology is important, I see almost everyone post technical analysis, but I don’t see anybody talking about the following.

I figure it may be helpful to someone out there if I go more in depth.

Everyone knows how to google a P/E ratio, and everyone knows how to draw a triangle, so why does everyone fucking suck at trading?

Because everyone listens to their brain, to their feelings. This is why you make bad decisions, it’s why you may do drugs, or jerk off, or eat unhealthily. You choose to listen to the dumbass in your brain that wants to receive dopamine, we all struggle with it, with our own issues. Especially me.

I am early in my trading career, I began in 2023, so you may think I just got/get lucky, I am too young, too inexperienced, whatever else. I am not writing from a place of ego, I am in an attempt to be provocative in order to grab your attention.

The earliest thing I knew about trading is that most people fail, most people suck at this game, and most ideas are wrong. Due to this, I knew to succeed I had to do the opposite of “everyone else”. That is why some people care a lot about sentiment, “Everyone is bullish, pain trade is down”.

It is true, most people are wrong, most people are shit, almost every legendary trader you’ve ever heard of has blown up multiple times.

So how have I, a 20 year old college dropout, achieve over 500% gains YTD?

It all started when I decided to read Best Loser Wins, I give that book (which often gets made fun of on FinX) credit for the formulation of my “edge”.

Essentially what the book taught me was what I have explained on X and I am explaining here, which is to ADD TO WINNERS, and CUT LOSERS SHORT.

Or as I call it, keeping the losers dry, and the winners juicy.

The Mechanics of the Press (How to Actually Do It)

Okay, so we established that most people are wrong because they are losing the fight against human nature. They buy, see green, get scared it will reverse, and sell. Or they get greedy and don’t roll stops up.

Your furu has probably told you to “lock in profits”.

NEWSFLASH!

Your furu is a fucking pussy.

On the other hand, people buy, see red, get hopeful, and become “bagholders” or “community members”.

I will admit, what works for me or your furu or you is what is best, don’t blindly follow someone’s ideas, especially mine. I may call you or your furu a pussy but it doesn’t mean you aren’t profitable, I have found my method to be the best for ME.

I do the opposite of the typical approach. I treat my positions like a snowball rolling down a hill. I don’t “lock in profits” or trim my positions. I don’t have price targets or close a trade at 2R or 3R or even 10R.

This isn’t about blindly doubling down. There is a specific way to do this so you don’t blow up your account when the trend inevitably snaps.

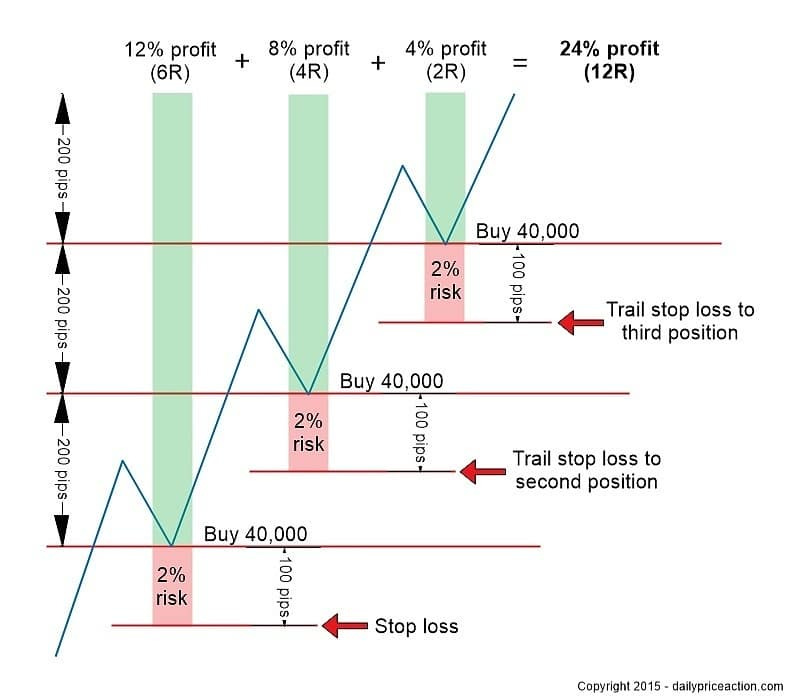

1. The “Free Roll” Concept Most people think adding to a position increases risk. If you do it my way, it actually decreases emotional risk while exploding your upside.

Let’s say I risk 1% of my account on a trade.

Step 1: The trade moves in my favor, then it begins moving against me toward my 1% stop, but creates a higher low.

Step 2: I move my stop loss on the first position to underneath that higher low, or somewhere comfortable. There isn’t an exact science, I always try to keep my stop in a place where I believe the trade idea is invalidated. No the fucking “algo” isn’t after me or you or whatever other bullshit you’ve heard.

Step 3: I buy a second lot, I use leverage, I size up.

Step 4: Repeat, over and over again.

If the market reverses now and hits my stop, I lose nothing (or next to nothing) on the trade.

I have doubled or tripled or quadrupled, etc. my exposure, but my actual risk is the same (or less). I am using the market’s money to finance the leverage.

Here is an image to provide a visual example.

2. Fighting the Vertigo This is where the “Dumbass Brain” kicks in again. When a chart is vertical, your brain screams, “It’s too high! It has to pull back!”

NO THE FUCK IT DOESN’T.

The market doesn’t “have” to do anything.

You have to tell your brain to shut up. Remember Newton’s Law? Objects in motion stay in motion. A chart going vertical is not a signal to sell; it is a signal that there is an imbalance of demand.

I buy into the strength. It feels like jumping onto a moving train. It’s scary, it’s hard. It feels reckless. But it is the only way to catch a 10R or 20R (or even more) on a move.

3. The Exit: Here is the catch: If you trade like this, you will never, EVER manage to sell the top.

Because I am always adding as it goes up, my average entry price moves up with me. When the trend finally breaks, I will get stopped out, and I will give back a chunk of open profit.

This destroys most people. They see their PnL go from +$10k to +$6k and they feel like they lost $4k.

I don’t. I see that $4k as the cost of doing business. If I tried to “lock it in” too early, I would have missed the times it went to +$20k or +$50k.

Conclusion: Value is in the Mind, Not the Chart I can’t sell you a course on some “Secret Pattern” or strategy or “Enigma” because there isn’t one. The chart is just a visual representation of mass psychology.

My “edge” is simply having the balls to press the accelerator when everyone else is hitting the brakes, and the discipline to cut the engine the second the car starts stalling.

It’s simple. It’s effective. And it’s why I am up more than most this year.

Even my favorite people, people much more experienced than me, tell me to lock in profits or size down. What works for them doesn’t work for me, and what works for me may not work for you.

Thank You for Reading

I hope you understand I don’t write from a place of ego, I don’t think I am smarter than anyone, I just want to help somebody out.

Above all else I hope to be as authentic as it gets, real, I try to tell the truth.

—

P.S. Obviously this strategy gets chewed up in choppy markets. I’m currently working on coding an indicator to detect “chop regimes” so I know when to sit on my hands. If I manage to get it working, I’ll share the code in a future post.

The fund - Manager

Chop regimes are hard to predict because you're banking on momentum stalling long enough for it to reverse trend. But we know momentum usually persists and it's hard to differentiate between a pullback vs. chop