ARM & The Macro Landscape

A Write-Up for my Friend's Dad | October 15th 2025

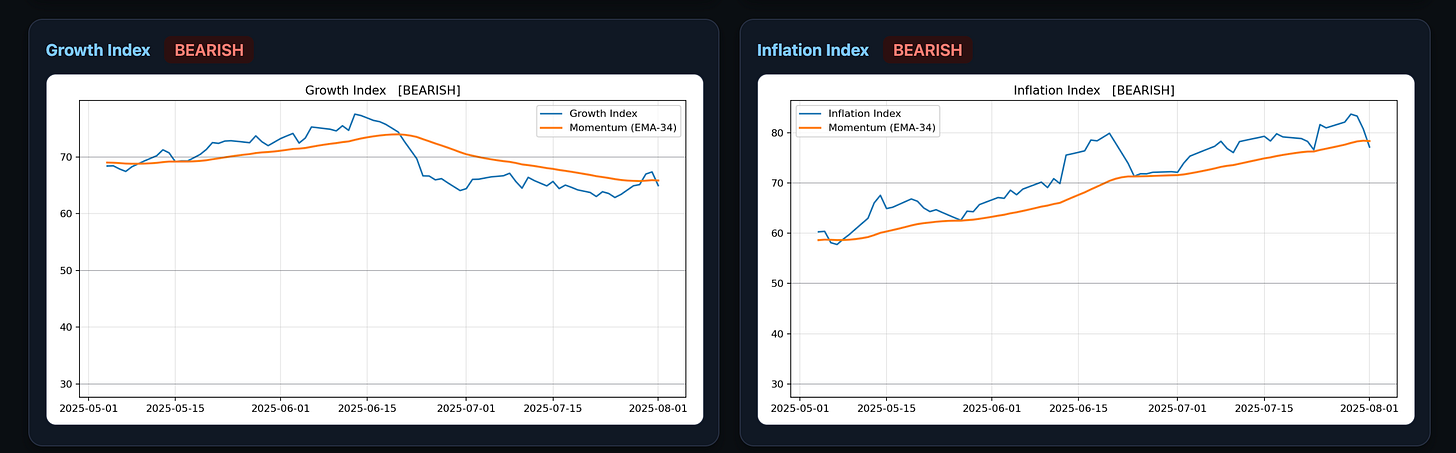

I have a few concerns about the macro landscape, I have been reducing a bit of my exposure in risk-on assets similar to ARM or other AI and data center and computing themes recently, because of decelerating growth. My heaviest position at the moment is Silver, “real” assets do well in regimes like this, as you know we have seen gold bid incredibly well, and it will likely continue until there is more certainty.

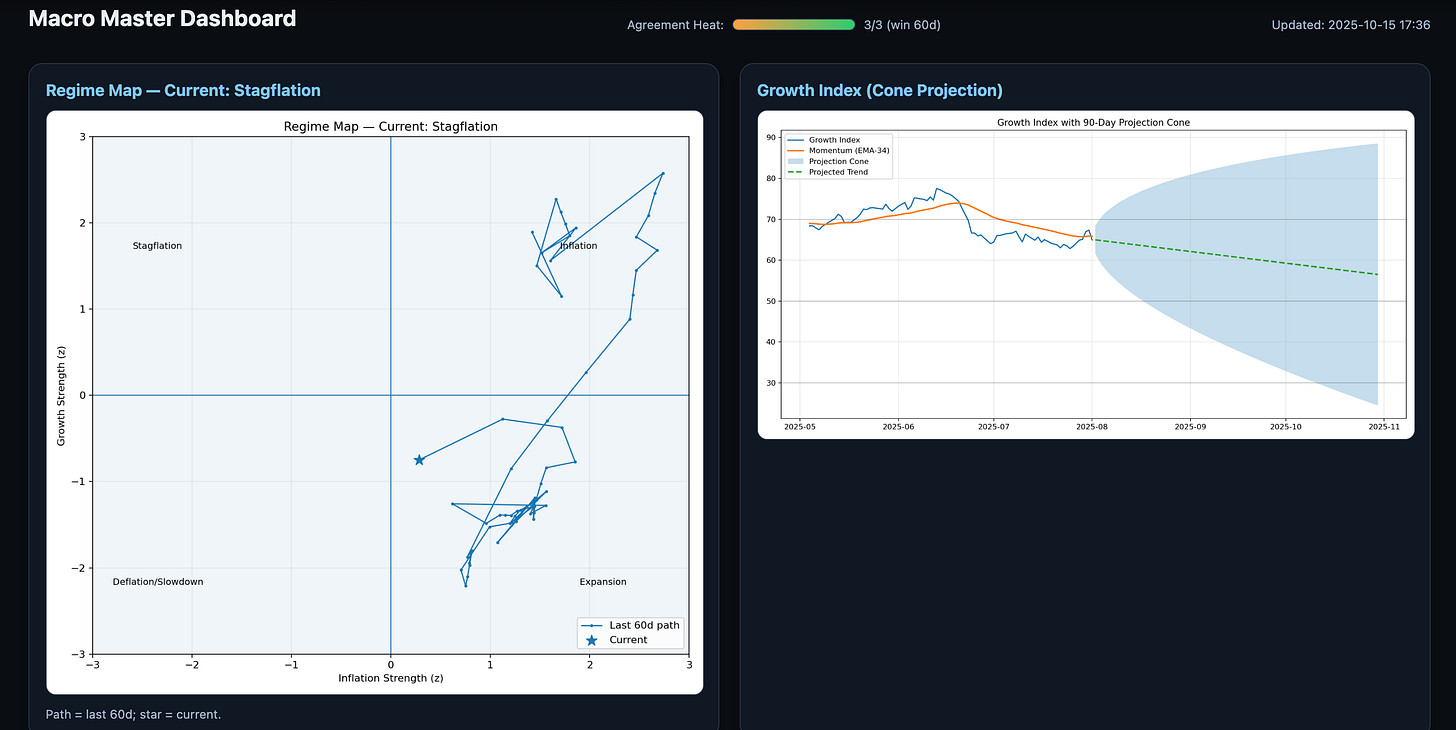

Here is something I built to analyze the macroeconomic-view currently.

Due to a deceleration in growth, the regime flipped from Expansion to Stagflationary leaning. This doesn’t mean we WILL or HAVE to stagflate or be in a stagflationary regime, that’s just the forward looking most probable scenario.

The other considerations I have are rate cuts in a couple weeks, a 100% probability of rate cuts are being priced in for the next meeting. That isn’t a direct increase of liquidity but as you can figure out, that would promote an increase the amount of debt businesses and individuals are taking on, increase in lending, which increases “liquidity” and that money has to go somewhere (likely risk assets IE: SPY and ARM)

This market is complete bullshit, it’s full ponzi, and it is this way because of mister Donald Trump. Because he is in office, I think he will do ANYTHING to keep the market propped up, but this is an opinion and not based in fact.

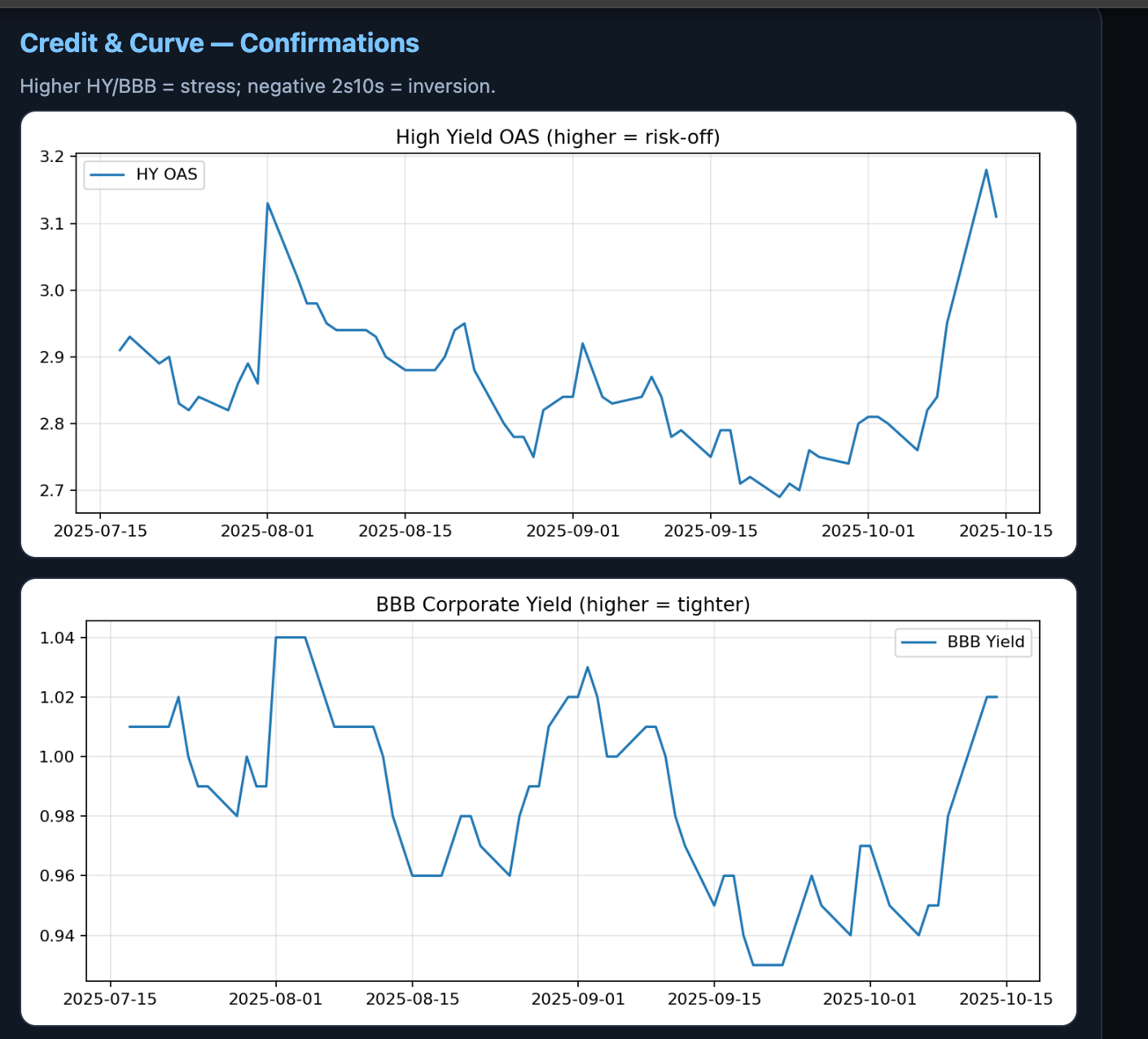

Positively, credit spreads are beginning to come back down, possibly due to the rate cuts coming up. This is good for risk assets like ARM.

Another important consideration to make is, China and Japan have lots and lots of foreign dollars in USD denominated assets, it is possible they are beginning to change their feelings about this and they could begin pulling investments from USD denominated assets and start building up their own markets and such.

This would obviously lead to a massive drawdown as US investors wouldn’t be able to prop up the insane amount of money being pulled out of the market.

My positioning:

I am currently highly leveraged long Silver, ES, and RTY. Silver being a bigger position than both of them combined, I am sometimes quickly in and out of positions though, but this is what I have been running throughout these last weeks/months.

I also have ITM long dated XLE calls, this is incase the Stagflationary scenario plays out and I’ll increase my size in that position if so, obviously reducing my ES and RTY longs.

The ARM Trade Idea:

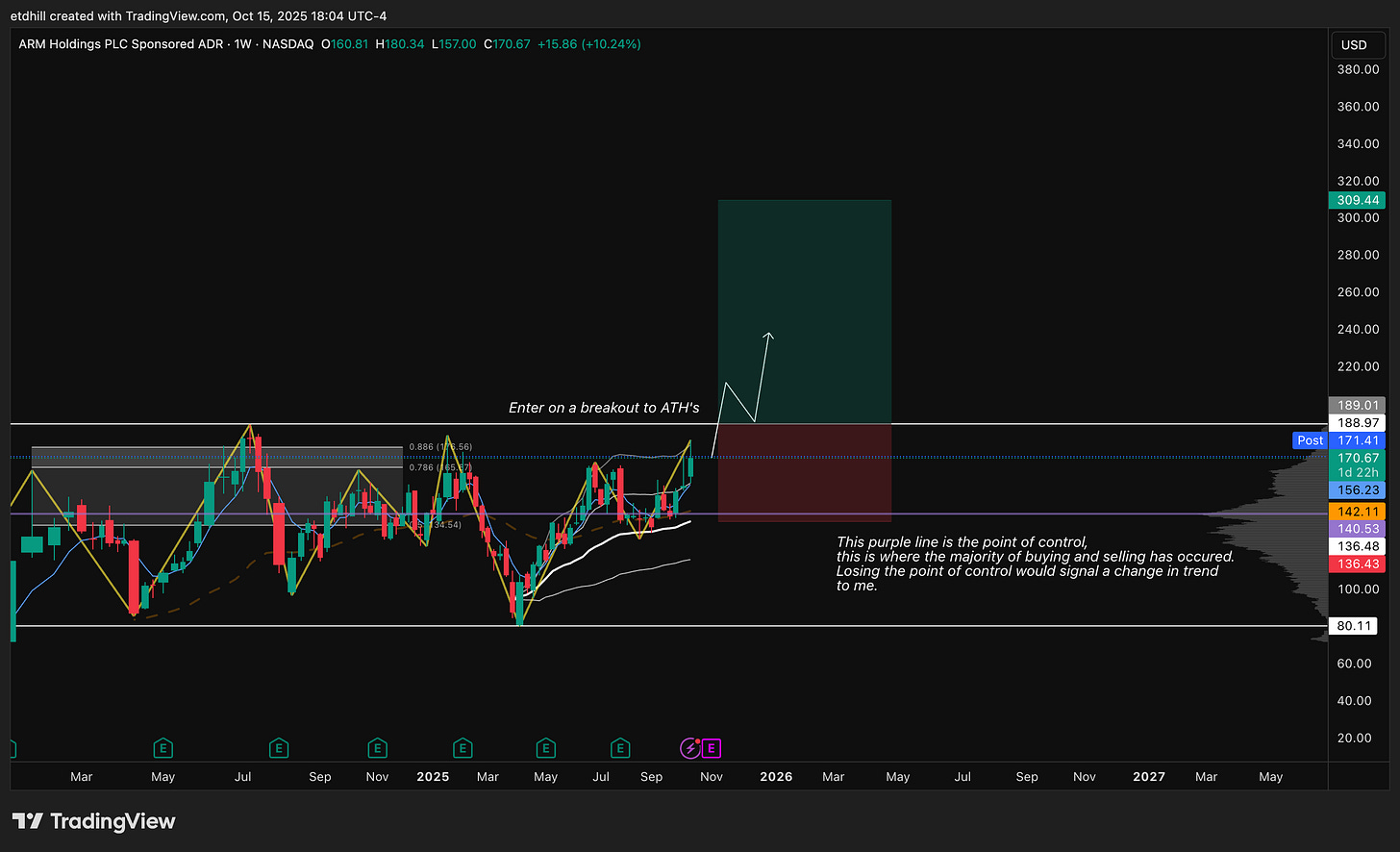

When regarding the technical side of things, something which has been ranging is likely to keep ranging. If you’re a pure technical guy you’re selling in the top half of this range, and buying in the bottom half of the range, it just makes sense.

In ranges, personally, I wait for a breakout of that range before going long, as that confirms a change in behavior.

This is how I would play the trade, IF you have conviction in ARM.

You cannot borrow conviction.

Conclusion:

The data suggests we lean toward stagflation, but I am not convinced yet, and tomorrow the model could flip back to Expansion or Inflationary melt-up.

Rate cuts and Donald Trump are short term bullish for the market.

It’s China and policy error that is what will likely fuck us later on.

The ARM trade makes some sense, but caution is crucial.